There Are Only Four Major U.S. Metro Areas Where It's Cheaper to … – Redfin News

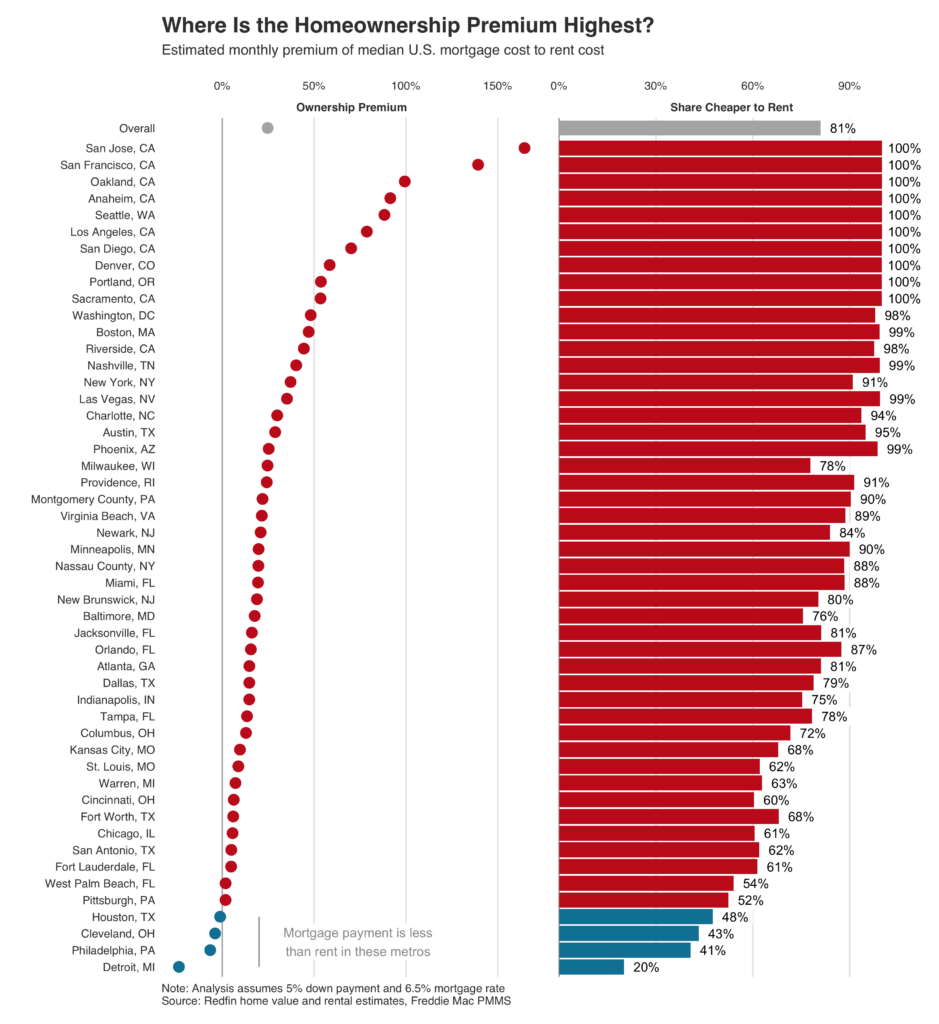

There are just four major U.S. metropolitan areas where it would be cheaper to buy than rent the typical home—that is, the typical home has an estimated monthly mortgage cost lower than its estimated monthly rental cost.

In Detroit, the typical home is 24% less expensive to buy than rent—the largest discount in percentage terms among the 50 most populous metros. The median estimated monthly mortgage payment for homebuyers is $1,296, compared with a median estimated monthly rent of $1,697. Next comes Philadelphia (7% ownership discount), followed by Cleveland (4% discount) and Houston (1% discount).

Nationwide, the typical home costs 25% more to buy than rent.

That’s according to a Redfin analysis of U.S. single-family homes, condos/co-ops and townhouses in the 50 most populous U.S. metros. We estimated what a homebuyer’s monthly housing payment would be on those properties using the Redfin Estimate of the homes’ value in March and a 6.5% mortgage interest rate—the average rate in March. We estimated what the monthly rent would be on those same homes using the Redfin Rental Estimate. When estimating monthly housing payments, we assumed a 5% down payment, homeowner’s insurance rate equal to 0.5% of the purchase price, and 1.25% annual property-tax rate if no tax records were available. This analysis includes homes that were for sale and rent in March, as well as those that were off the market. Historical Redfin data is not available at this time.

“Buying a home often makes more financial sense than renting if you can afford a down payment and monthly mortgage because you’re building equity. When you own your home, your home pays you; when you rent, you and your home pay your landlord,” said Redfin Deputy Chief Economist Taylor Marr. “But buying isn’t a feasible option for everyone. Some people move around a lot, so renting might make more sense because they won’t be in their home long enough to build equity. Many others simply don’t have the money for a down payment—a situation that has become increasingly common due to rising mortgage rates and elevated home prices.”

In Detroit, Philadelphia, Cleveland and Houston, it’s cheaper to buy a house than rent one because home values in those areas have stagnated relative to the country as a whole. When house hunters can’t build a lot of equity, they have less of an incentive to pay a premium to own, Marr said.

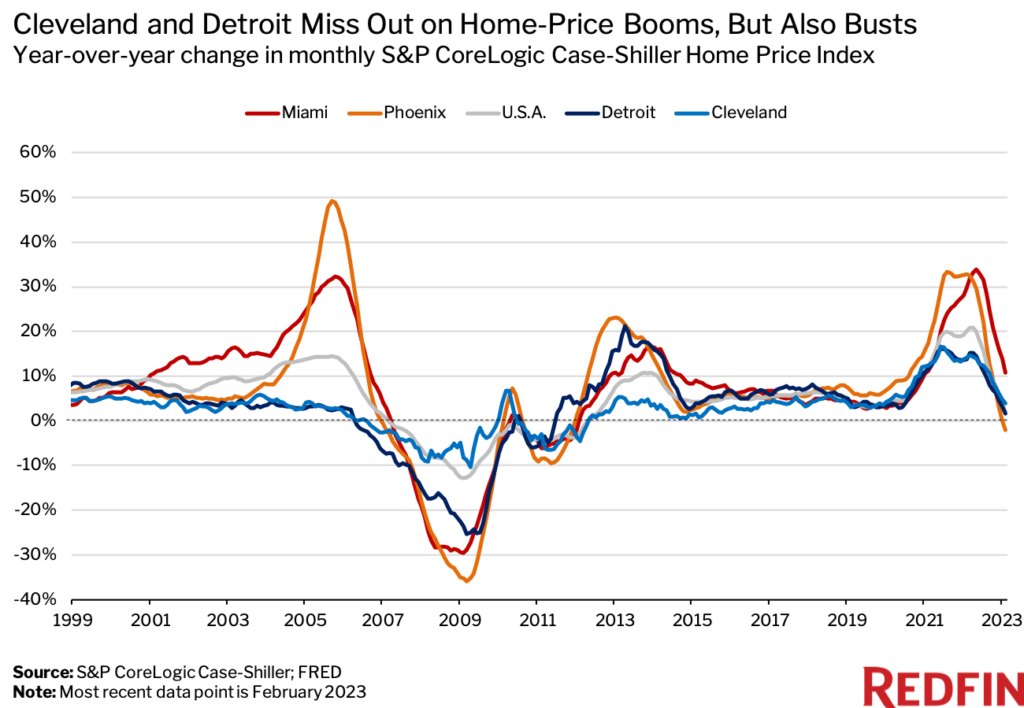

It’s a double-edged sword, though; home values in Cleveland and Detroit are stagnant compared to pandemic boomtowns like Phoenix and Miami, so they don’t experience huge booms, but that also means they don’t experience the huge busts that are currently underway in much of the U.S. When more people can afford to buy homes—even if they’re not building a ton of equity—there is also more wealth equality, Marr added.

In Detroit, 80% of properties are cheaper to buy than rent—the highest share in the U.S. Next comes Philadelphia (59%), followed by Cleveland (57%) and Houston (52%). That compares with a nationwide share of 19%.

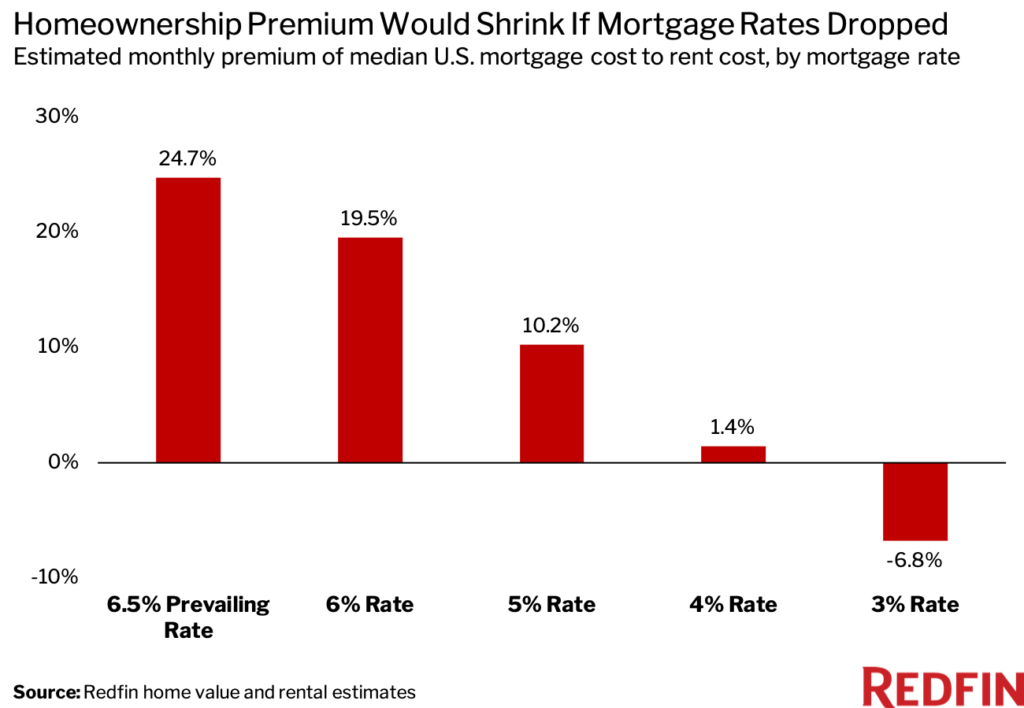

Detroit, Philadelphia, Cleveland and Houston are outliers. For homebuying to become cheaper than renting in other parts of the country, mortgage rates would need to fall substantially.

If the 30-year-fixed mortgage rate dropped to 5%, the median estimated monthly mortgage payment for homebuyers would be $2,993, or 10% higher than the $2,716 median estimated monthly rent. That’s significantly lower than today’s 25% homeownership premium, with an estimated monthly mortgage payment of $3,385 and an estimated rent of $2,715.

If rates dipped to 4%, the estimated premium would shrink to 1%. And if they fell back down to 3%, it would actually be 7% cheaper to own. Please note that these calculations use estimated home values from March and prices and rents could change significantly if mortgage rates fall.

Mortgage rates will likely fall below 6% by the end of the year as the Federal Reserve makes progress in its fight against inflation, but they’re unlikely to return to 3% levels anytime soon, Marr said. A national survey by Fannie Mae found that 22% of consumers surveyed in April think mortgage rates will fall, up from 12% the prior month.

“I wouldn’t encourage people to squeeze their budgets in order to buy a home when prices are falling and we’re teetering on a recession,” Marr said. “In the years leading up to the pandemic, it made sense for some homebuyers to break the rule that says not to spend more than 30% of your income on monthly housing costs, but these times are more risky, so it makes sense to be a little more conservative.”

While renters don’t build home equity, they do avoid the high costs that come with maintaining and selling a home. Some renters may also choose to invest the money they’re not putting toward homeownership into other lucrative asset classes.

In San Jose, CA the typical home is 165% more expensive to buy than rent—the largest premium in percentage terms among the 50 most populous metros. The median estimated monthly mortgage payment for homebuyers is $11,049, compared with a median estimated monthly rent of $4,176.

Next comes San Francisco (139% ownership premium), Oakland, CA (99% premium), Anaheim, CA (91% premium) and Seattle (88% premium).

In the aforementioned metros, 0% of homes are cheaper to buy than rent.

Homebuying is more expensive than renting in most of the country because it comes with perks: wealth building opportunities, fixed monthly costs and tax benefits, to name a few. The premium is highest on the West Coast because that’s where homebuyers expect the wealth building potential to be largest based on historical evidence, Marr explained.

The rise in mortgage rates over the last year has increased the homeownership premium to the highest level since the 2006 housing bubble and widened the gap between buyers and renters by pushing homeownership further out of reach for many people. Nowhere is the housing affordability crisis more severe than in pricey coastal markets like the Bay Area and Seattle, where a jump in mortgage rates can mean a homebuyer’s monthly payment goes up by thousands of dollars.

The upside is that because those markets have become so prohibitively expensive—partly due to rising mortgage rates and partly due to the surge in home prices during the pandemic—they’re now seeing home prices come down faster than nearly anywhere else in the U.S. Median sale prices in San Jose and Oakland dropped roughly 10% year over year in March, triple the nationwide decline. Rents have also been falling in some pricey coastal markets, but at a slower pace than home prices.

It probably doesn’t come as a surprise that there are virtually no homes in the Bay Area that are cheaper to buy than rent. But that’s now also the case in Sacramento, CA, Las Vegas, Phoenix and Austin, TX—metros that not long ago were fairly affordable. They exploded in popularity—and price—when scores of remote workers moved in during the pandemic.

In Sacramento and Las Vegas, less than 1% of homes are cheaper to buy than rent. In Phoenix, the share is 1%, and in Austin, it’s 5%. All four metropolitan areas ranked on Redfin’s list of most popular migration destinations during the pandemic.

“Housing affordability is an issue in Las Vegas. During the pandemic homebuying boom, we had a lot of people moving in from high-priced coastal areas. That caused home prices to soar faster than wages, creating a disadvantage for locals looking to buy,” said local Redfin Premier real estate agent Shay Stein. “The good news is that because the market has slowed, sellers are willing to accept offers from buyers who use FHA loans and down-payment assistance programs, and some are even throwing in money to help with mortgage-rate buydowns. All of that was unheard of during the 2021 homebuying frenzy.”

As a data journalist, Lily is passionate about helping readers understand complex facets of the housing market. She is particularly interested in the issues of climate change, race and gender equality and housing affordability. Prior to working at Redfin, Lily spent four years as a reporter at Bloomberg News in New York City.

Taylor Marr is the deputy chief economist on the research team at Redfin. He is passionate about housing and urban policy and an advocate for increased mobility and affordability. He laid the framework for our migration data and reports and diligently tracks the housing market and economy. Before Redfin, Taylor built financial market index funds for Vanguard at the University of Chicago. Taylor went to graduate school for international economics in Berlin, where he focused on behavioral causes of the global housing bubble and subsequent policy responses. Taylor’s research has been featured in the New York Times, the Wall Street Journal, and The Economist. He was also recently the President of the Seattle Economics Council and collaborates frequently with the Fed, HUD, and the Census Bureau. Follow him on Twitter @tayloramarr or subscribe to his weekly newsletter on Substack here: https://taylormarr.substack.com

By submitting your email you agree to Redfin’s Terms of Use and Privacy Policy

Join Us

About Us

Find Us

Countries United States

United States Canada

Canada

Updated January 2020: By searching, you agree to the Terms of Use, and Privacy Policy.

REDFIN IS COMMITTED TO AND ABIDES BY THE FAIR HOUSING ACT AND EQUAL OPPORTUNITY ACT. READ REDFIN’S FAIR HOUSING POLICY.

Copyright: © 2022 Redfin. All rights reserved. Patent pending.

REDFIN and all REDFIN variants, TITLE FORWARD, WALK SCORE, and the R logos, are trademarks of Redfin Corporation, registered or pending in the USPTO.

California DRE #01521930

NY Standard Operating Procedures

TREC: Info About Brokerage Services, Consumer Protection Notice

If you are using a screen reader, or having trouble reading this website, please call Redfin Customer Support for help at 1-844-759-7732.