SomeraRoad gets $64M incentive package for 15-year West Bottoms overhaul

SomeraRoad Inc. secured a public financing framework that will support 13 new-build and historic renovation projects in a $526.7 million “live-work-play” redevelopment it plans to carry out in Kansas City’s West Bottoms over the next 15 years.

The city’s Planned Industrial Expansion Authority on Thursday voted 10-2 to approve $64.3 million in incentives for the New York developer to build 1,102 apartments, 40 hotel rooms, 137,923 square feet of retail space and 122,794 square feet of office space over more than 17 acres in the central West Bottoms.

“We are excited to take this important step in continuing a transformative public/private partnership with the City of Kansas City,” said Andrew Donchez, a principal at SomeraRoad, in a statement after the PIEA’s vote. “The PIEA’s investment in the revitalization of the West Bottoms through supporting the creation of much needed housing, historic preservation, infrastructure, safety improvements and public spaces will be a catalyst for job creation, economic development and future growth.”

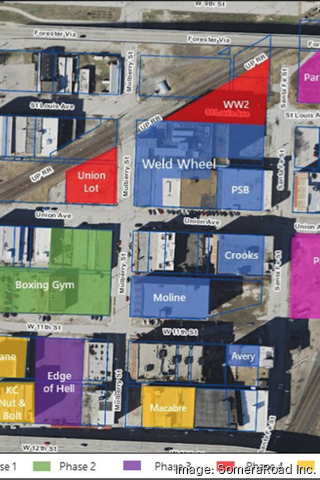

This map shows the layout of the different West Bottoms properties where SomeraRoad’s new-build and adaptive reuse projects are planned.

What was debated?

Much of Thursday’s discussion among PIEA members centered on SomeraRoad’s public financing needs. The developer said its request was based on the West Bottoms’ unproven market for new and adaptive reuse projects, as well as costs to remediate blight within historic buildings. Some buildings are at the “tipping point” of being salvageable, Donchez said.

SomeraRoad’s approved request includes 20-year property tax abatements above the city’s incentive caps for projects in its first two phases — at 90% for 10 years, followed by 75% for the next 10. From there, projects in the next three phases will receive 15-year abatements, at 70% for 10 years and 30% for the next five. That comes out to an estimated $50.8 million in abatements, plus $13.5 million in sales tax exemptions on construction materials, according to PIEA materials.

Those terms were scaled back from what SomeraRoad originally had sought: 25-year abatements at varying levels for all five phases, totaling $67.8 million. However, third-party financial consultant SB Friedman Development Advisors said lower 15-year levels for the first two phases, or $32.2 million in total abatements, still appeared to allow the redevelopment to move forward.

Two PIEA members, David Valdiviezo and Andrea Flinders, introduced a measure to approve incentives at SB Friedman’s alternate levels. The rest of the board voted the motion down, after Charles Renner, a Husch Blackwell attorney representing SomeraRoad, said a vote in favor would equal a vote “no” on the redevelopment. The higher request drew a rebuke from Kathleen Pointer, senior policy strategist with Kansas City Public Schools, who said close to 75 teachers had written to the PIEA in opposition.

“We have a third-party financial analysis for a reason, don’t we?” Pointer said Thursday. “We should not let developers dictate what they want. We should follow an analysis on what they need.”

SB Friedman found that affected taxing jurisdictions would net $58.4 million in property tax revenues over a 25-year period under the approved terms, as compared to $40.9 million under SomeraRoad’s original request, or $76.6 million under the lower alternate. As is, the properties would yield about $2.5 million in property taxes over the same timeframe.

Additional discussion at the PIEA meeting revolved around developer check-ins, with relation to public financing needs. A development agreement approved between SomeraRoad and the PIEA called for a new third-party analysis after the second project phase’s completion. At Flinders’ request, the developer agreed to check-ins after each of its five phases.

Lance Dorn, of SB Friedman, said officials could reduce incentives for future phases if previous ones end up outperforming projections, but this would not include clawbacks of previous public financing. Renner said such a provision would be viewed as equal to a lack of an incentive in the project’s underwriting. Dorn said that’s an issue specific to local and regional financial institutions.

“The one thing that we hear specifically in Kansas City is that local and regional lenders just aren’t sure how to deal with this, but this is something that happens really throughout the country in terms of clawbacks,” he said.

SomeraRoad aspires to bring about a potential Kansas City equivalent to Ponce City Market in Atlanta and Industry City in Brooklyn through long-term redevelopment in the historic West Bottoms.

The developer’s road ahead

The city’s Tax Increment Financing Commission is scheduled Nov. 14 to review a TIF plan that would fund an approximately $58 million overhaul of the neighborhood’s public utilities and infrastructure, some of which dates back more than 120 years, plus streetscape beautification and blight removal.

Additional TIF plan proceeds also are planned to help SomeraRoad comply with the city’s affordable housing set-aside requirements, according to PIEA documents.

Pending remaining approvals, SomeraRoad plans to start work in November with demolition of the former Weld Wheel Industries Inc. building to create a new apartment site. From there, it looks to start its first infrastructure work in April, corresponding with its start of private construction.

An updated breakdown of SomeraRoad’s phased plans is as follows. The figures are based on details the developer provided SB Friedman; most fall within broader unit and square footage ranges shared in a developer presentation Thursday, illustrating their potential to change as project phases progress.

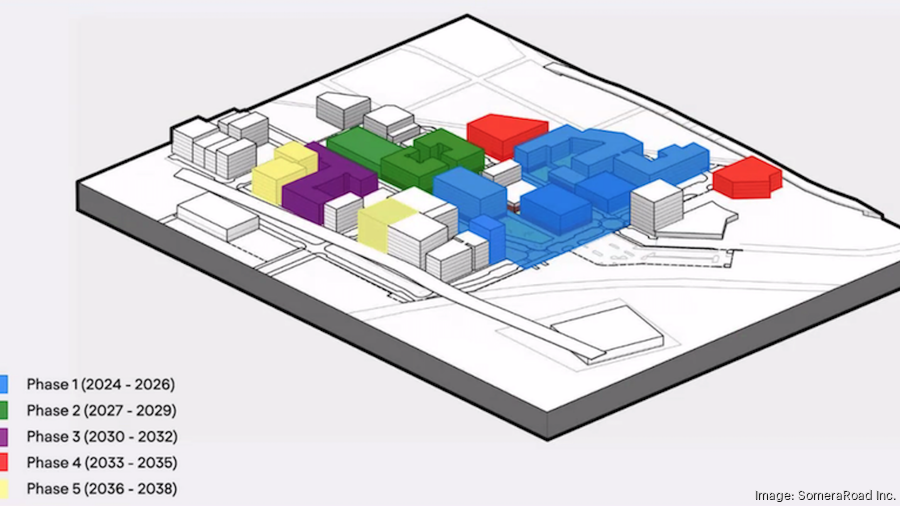

This map reflects the West Bottoms properties included in SomeraRoad’s five-phase neighborhood redevelopment.

Phase One:

- 290 new apartments, 9,207 retail square feet in place of the Weld Wheel building: $86 million (2025-2028)

- Adaptive reuse of the Moline Plow Building with 121 apartments, 23,187 retail square feet: $52.2 million (2024-2027)

- Renovation of the Avery Building as a 40-key hotel: $25.5 million (2024-2025)

- Adaptive reuse of the Perfection Stove Co. Building with 32,752 office square feet, 23,920 retail square feet: $21.3 million (2024-2026)

- Adaptive reuse of the Crooks Terminal Warehouse Co. Building with 75,250 office square feet, 30,411 retail square feet: $33.5 million (2024-2027)

Phase Two:

- 178 new apartments, 12,458 retail square feet in place of boxing gym northwest of 11th and Mulberry streets: $59.3 million (2027-2030)

- Renovation of former fire station at 1215 Union Ave. with 3,000 retail square feet: $2.9 million (2026-2027)

Phase Three:

- 210 new apartments, 4,086 retail square feet next to the Edge of Hell Haunted House: $79.3 million (2030-2033)

- Alternate scenario project could include 150,000 office square feet

Phase Four:

- 76 new apartments on lot northeast of Weld Wheel apartment site: $31.8 million (2033-2038)

- 72 new apartments, 1,575 retail square feet on lots northwest of Mulberry Street and Union Avenue: $27.1 million (2033-2035)

Phase Five:

- Adaptive reuse of the Crane Co. Building with 40 apartments: $26.8 million (2035-2037)

- Adaptive reuse of the Kansas City Bolt Nut & Screw Co. Building with 45 apartments, 10,230 retail square feet: $31.4 million (2036-2038)

- Adaptive reuse of the Macabre Cinema Haunted House with 70 apartments, 13,797 retail square feet: $49.7 million (2036-2038)

- Alternate adaptive reuse of Macabre building could include 40,000-60,000 office square feet, 10,000-15,000 commercial square feet