More Than 2 in 5 Home Sellers Are Making Concessions to Buyers … – Redfin News

Sellers are handing out freebies to attract bidders as high mortgage rates dampen homebuying demand. But in some markets, there are so few homes for sale that sellers are bringing in multiple offers and don’t have to offer concessions.

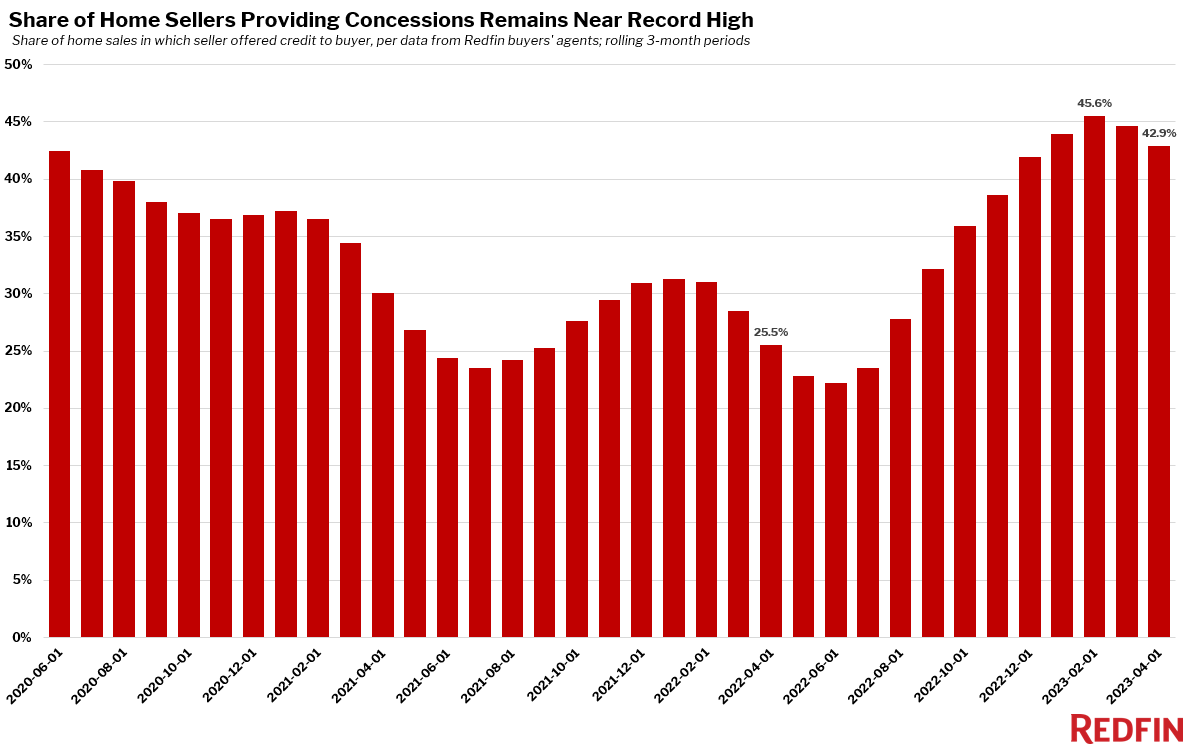

Home sellers gave concessions to buyers in 42.9% of U.S. home sales during the three months ending April 30, up from 25.5% a year earlier, as elevated mortgage rates cooled homebuyer demand. That’s just shy of the 45.6% record-high hit in February.

This is according to data submitted by Redfin buyers’ agents across the country, going back through 2020. A concession is recorded when an agent reports a seller provided something that helped reduce the buyers’ total cost of purchasing the home. That could include money toward repairs, closing costs and/or mortgage-rate buydowns. It does not include situations in which the seller lowered the list price of their home or lowered the price due to negotiation with a buyer.

The share of home sellers providing concessions has inched down from February’s peak. That’s due to typical seasonality. Concessions become less common in the early spring because that’s when more buyers typically enter the market, increasing competition and giving sellers more power. But this spring, concessions posted a smaller decline than the last two years because high mortgage rates have made it so sellers in cool markets–like pricey West Coast places and pandemic boomtowns–need to take extra measures to woo and secure buyers. The likelihood of a seller giving a concession dropped 6% from February to April, compared with 18% drops during the same period in 2021 and 2022. This spring’s smaller drop corresponds with less homebuyer competition, with 46% of offers written by Redfin agents facing a bidding war in April, down from 59% a year earlier.

Sellers are throwing in freebies to woo buyers at a higher frequency than last year for several reasons:

While buyers have the upper hand in some markets, that’s not the case everywhere. In some areas, there are so few homes for sale that homebuyers are encountering competition. And when buyers are involved in a bidding war, they typically won’t win if they ask for concessions like mortgage-rate buydowns or help with closing costs.

“High mortgage rates and low supply have thrown the housing market out of whack, and each deal is different. Some buyers are asking sellers for the sun, the moon and the stars in addition to offering below the asking price, and some are requesting no extras because they’re so motivated to secure one of the few homes on the market,” said Boise, ID Redfin Premier agent Shauna Pendleton. “The one consistency in the market right now is homebuilders handing out freebies. Most builders are offering concessions equal to about 3% of the sale price, which gets credited to buyers at closing, to offload properties. Buyers are using the extra cash to cover closing costs or buy down their mortgage rate.”

The housing market has done an about-face in the last year. In April 2022, at the tail end of the pandemic homebuying boom driven by record-low mortgage rates and remote work, high demand paired with low supply meant sellers were firmly in control. Buyers were typically unable to secure concessions or even include things like inspection contingencies in their offers.

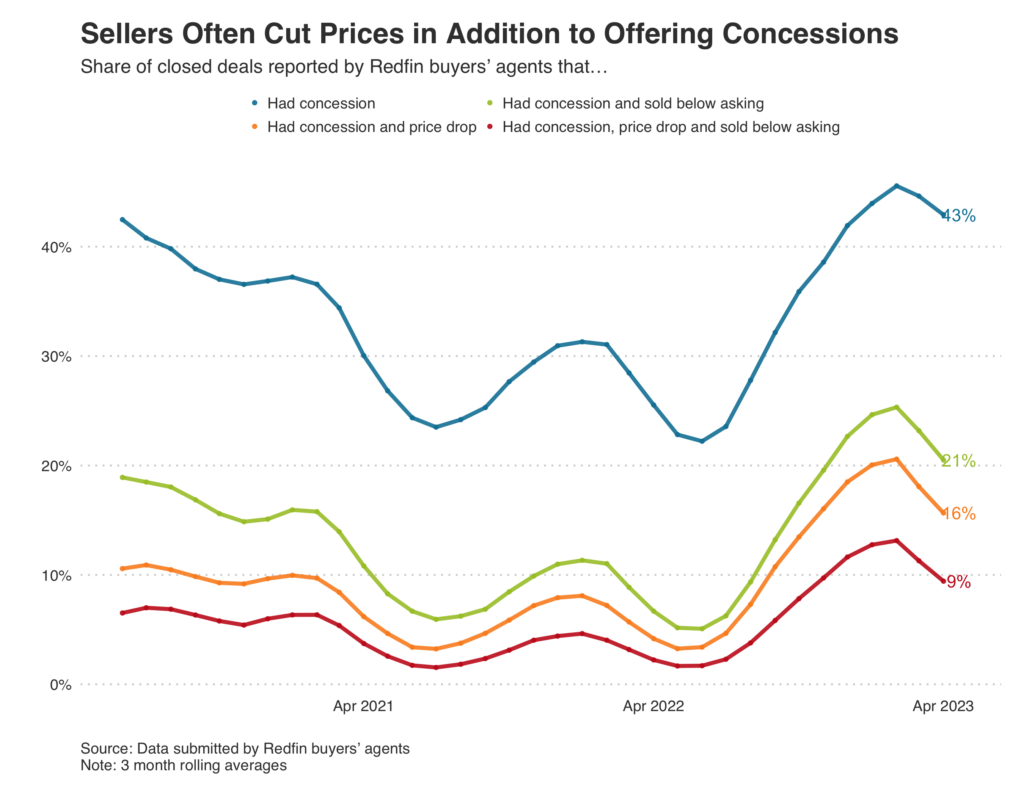

The share of sellers parting ways with their home for less money than they originally wanted is also much higher than it was last year, per Redfin’s data. Selling for less money can happen when a seller cuts their asking price, accepts an offer below the asking price or both.

Just over one in seven (15.7%) home sellers dropped their asking price in addition to providing a concession to the eventual buyer during the three months ending April 30. That’s nearly four times the share of a year earlier (4.2%).

Roughly one in five (20.5%) of homes that sold during the period had a final sale price below the asking price in addition to a concession, up from about 7% a year earlier. And about one in 10 (9.4%) had all three: A concession, a price drop and a final sale price below the original list price. That’s up from just 2.2% a year earlier.

Those shares have all inched down from record highs set in February, which is typical for this time of year, and 2023’s declines are actually smaller than the declines in 2021 and 2022.

Tampa, FL saw a bigger year-over-year jump in seller concessions than any other metro Redfin analyzed. Sellers in Tampa gave concessions to buyers in 58% of home sales during the three months ending April 30, up from 12% a year earlier.

The next-biggest increases were in Nashville, TN (49%, up from 5.6%), Salt Lake City (46.8%, up from 12.3%), Seattle (45.7%, up from 11.7%) and Raleigh, NC (64.6%, up from 31.2%).

Most of the metros above are pandemic homebuying hotspots where demand soared as remote workers sought relatively affordable, warm parts of the country. That drove prices to unsustainably high levels, which is why homebuyer demand in many of these markets is now cooling quickly and sellers are struggling to attract buyers.

The share of sellers giving out concessions rose over the last year in all metros Redfin analyzed. The increases were smallest in Atlanta (42.7%, up from 40.7%), Chicago (44.7%, up from 41.1%) and Boston (15.9%, up from 12%).

Sellers in Phoenix gave concessions to buyers in 68.5% of home sales in the three months ending April 30, the highest share of the metros Redfin analyzed and nearly double 35.9% a year earlier.

San Diego (66.1%), Raleigh (64.6%), Las Vegas (59.1%) and Denver (58.1%) rounded out the top five. Like the metros where concessions rose most, these are all places where homebuying demand skyrocketed during the pandemic and is now waning.

Boston sellers only provided concessions in 15.9% of home sales, the lowest share of the metros in this analysis. Next came San Jose, CA (17.3%), New York (19.1%), Philadelphia (27.8%) and San Antonio, TX (37.1%).

The table below includes 27 metros for which Redfin buyers’ agents recorded at least 50 closed deals during the three months ending in April, in both 2023 and 2022. The national data in the first section of the report are representative of the entire U.S.

As a data journalist at Redfin, Dana Anderson writes about the numbers behind real estate trends. Redfin is a full-service real estate brokerage that uses modern technology to make clients smarter and faster. For more information about working with a Redfin real estate agent to buy or sell a home, visit our Why Redfin page.

By submitting your email you agree to Redfin’s Terms of Use and Privacy Policy

Join Us

About Us

Find Us

Countries United States

United States Canada

Canada

Updated January 2020: By searching, you agree to the Terms of Use, and Privacy Policy.

REDFIN IS COMMITTED TO AND ABIDES BY THE FAIR HOUSING ACT AND EQUAL OPPORTUNITY ACT. READ REDFIN’S FAIR HOUSING POLICY.

Copyright: © 2022 Redfin. All rights reserved. Patent pending.

REDFIN and all REDFIN variants, TITLE FORWARD, WALK SCORE, and the R logos, are trademarks of Redfin Corporation, registered or pending in the USPTO.

California DRE #01521930

NY Standard Operating Procedures

TREC: Info About Brokerage Services, Consumer Protection Notice

If you are using a screen reader, or having trouble reading this website, please call Redfin Customer Support for help at 1-844-759-7732.