7 Best-Performing Virtual Reality Stocks for October 2023

Virtual reality (VR) is not exactly a brand-new technology — certain kinds of gaming and developer headsets have been available since the mid-2010s. But it’s not quite mainstream, either. Most people aren’t replacing Zoom calls with VR conferences just yet.

That could change soon, due to two product launches. Apple’s much-anticipated Vision Pro headset is due to hit shelves next year, while Meta’s Quest 3 became available for preorder in Sept. 2023.

Neither product’s success is assured — and neither is particularly cheap. Apple’s Vision Pro will debut at a price of $3,499, while Meta’s Quest 3 starts at a slightly more reasonable $499. But the two launches bring VR technology a couple of steps closer to widespread adoption — and they present an interesting opportunity to learn about virtual reality stocks.

What are virtual reality stocks?

Virtual reality stocks — which are also sometimes called “metaverse stocks,” after the “metaverse” of cyberspace that exists within virtual reality — are shares of publicly-traded companies that serve the market for VR technology in some way.

Some make hardware, such as VR headsets or graphics processing units. Others make software, such as tools that allow artists to design works in VR. Still others are VR content creators, such as video game studios.

For the purposes of this article, we are also including companies involved with augmented reality (AR) technology, as AR has similar components to VR and is often being developed by the same companies.

The difference between VR and AR is whether or not you can see the outside world. VR typically refers to headset technologies that create fully-immersive experiences in virtual space, while AR refers to technologies that use special glasses or smartphones to put virtual overlays on top of the real world.

Advertisement

7 top virtual reality stocks by one-year performance

Below are the seven best-performing stocks in the Global X Metaverse Index, an index of virtual reality and augmented reality stocks that trade on major U.S. exchanges. The stocks are ordered by one-year performance.

|

Advanced Micro Devices Inc. |

||

Source: Finviz. Stock data is current as of Oct. 2, 2023 and for informational purposes only.

Pros and cons of virtual reality stocks

Like any investment, virtual reality stocks have a unique mix of upsides and downsides.

Pros of virtual reality stocks

-

Potentially-transformative technology. Being an early backer of a technology that goes on to change the world is a dream for many tech investors. There’s no guarantee that VR will have the same kind of economic impact that computers, the internet or smartphones did — but if it does, investors will want to be there for it. The popularity of social media apps that have AR features, such as Snapchat and TikTok, suggests widespread interest in the technology.

-

Blue-chip stocks with strong performance. Betting on an emerging technology often means making risky investments in small, new companies — but that’s not the case for VR. Most of the companies on the list above are the kinds of large-cap tech stocks that have been carrying the S&P 500’s return over the last year. They’re not without risk, but they’re considerably more stable than a typical startup.

Cons of virtual reality stocks

-

Potentially a fad. VR technology could go the way of the PC or the smartphone, but it could also go the way of cryptocurrency or NFTs. The VR industry has a history of booms and busts in which widespread adoption seemed to be just around the corner but never came. It’s too early to rule out that possibility with the forthcoming products from Meta and Apple.

-

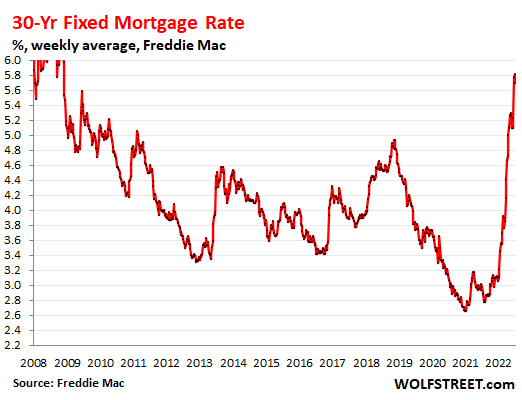

Interest rate sensitivity. Many big tech stocks, including some of the ones in the table above, saw their share prices drop in 2022, as interest rates rose and made the companies’ substantial debt burdens more expensive to service. If inflation is more persistent than expected and the Federal Reserve decides to raise rates again, it could hit VR stocks hard.

How to buy virtual reality stocks

There are a few different ways to get exposure to virtual reality stocks — the right one for you will depend on your investment situation and objectives.

Individual virtual reality stocks

One approach is to buy shares of individual virtual reality companies. Some of the VR stocks in the table above are significantly beating the S&P 500’s long-term annual average return of 10% before inflation.

However, buying individual stocks — especially tech stocks — can be pricey if you’re not using a broker that offers fractional shares. Most of the companies in the table above have triple-digit share prices.

It’s important to research stocks before buying to make sure that initial purchase is worthwhile, as individual stocks can be riskier than an index like the S&P 500.

Virtual reality ETFs

There are also exchange-traded funds (ETFs) dedicated to virtual reality stocks, such as the Global X Metaverse ETF (VR) and the ProShares Metaverse ETF (VERS). Both offer investors exposure to dozens of virtual reality stocks with a single purchase.

However, like individual stocks, ETFs come with risk, too, and it’s important to research their holdings before buying.

The author owned shares of Alphabet at the time of publication.